From Debt to Direction: How One Meath Client Is Turning Cash Flow into Long-Term Freedom

Just last week, I met with a client here in Meath whose story really highlights a common financial challenge — earning a great income but still feeling stuck.

He's 41, single, and earning €160,000 per year. On the surface, that's a strong position to be in. But as we dug into his finances, it became clear that between car repayments, credit card balances, and lifestyle spending, there wasn't much left to put aside for retirement.

His question was simple but familiar:

"I know I need to save for the future — but where do I start when it feels like everything's already spoken for?"

Seeing the Full Picture with Voyant

We began by building a complete financial picture using Voyant, the financial planning software I use to bring plans to life visually. It allowed us to map out his current debts, income, and spending, and then simulate what happens over time as changes are made.

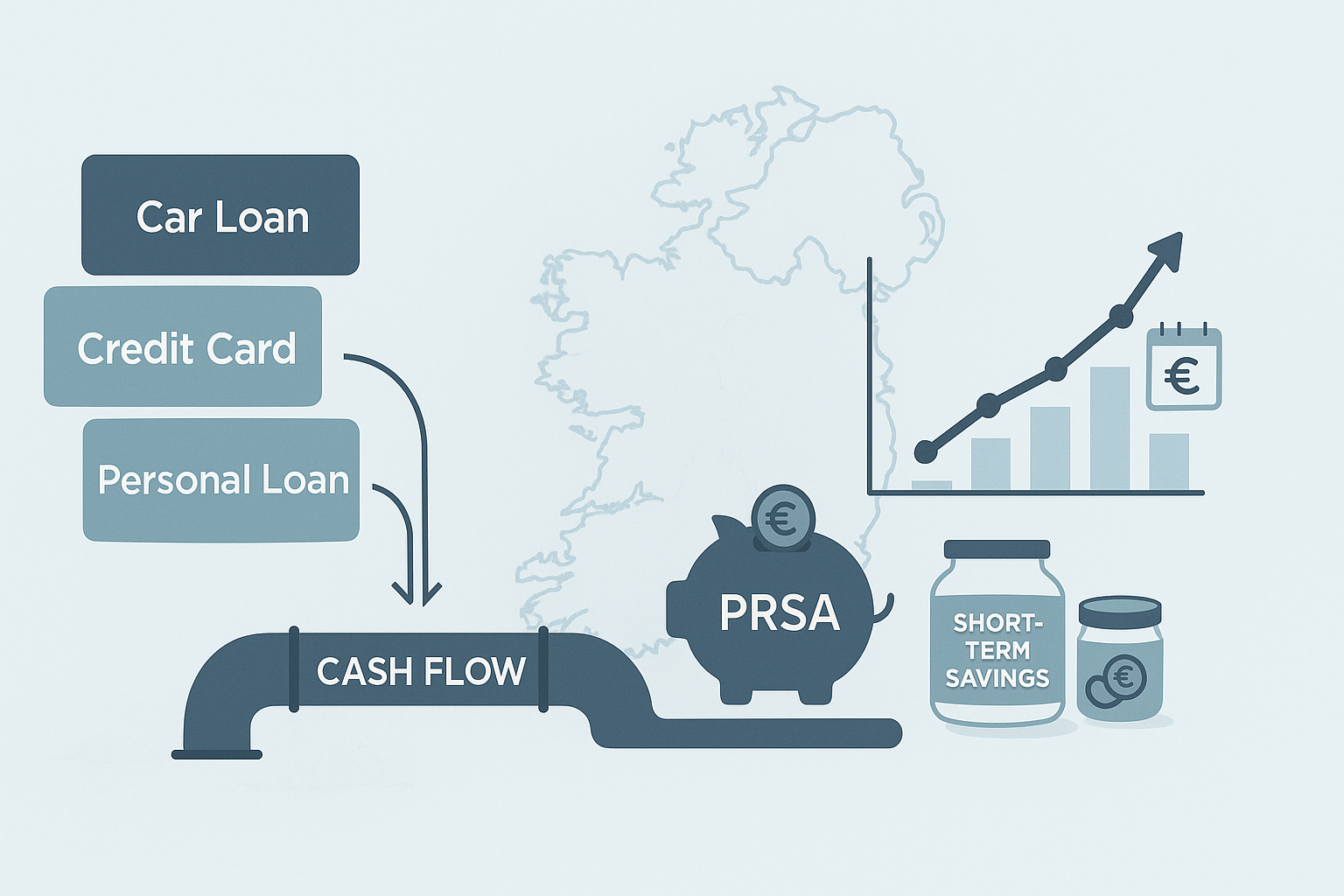

Together, we looked at how each debt could be paid off, one by one, and how those same repayments could be redirected into a PRSA (Personal Retirement Savings Account) & short term savings to avoid debt when possible, instead of disappearing into everyday spending.

The real value of Voyant is that it shows the long-term impact of today's decisions. On screen, we could see:

- How the smallest debt disappearing first creates new cash flow.

- How that freed-up money, once moved into his PRSA, begins to grow.

- And how, over time, the cumulative effect builds serious momentum for retirement.

It's a great visual for clients — the debt commitments go down; the savings line goes up — a perfect illustration of progress and purpose.

Using the Debt Repayment Snowball

To make the plan simple and achievable, we used the debt snowball method you may have heard US Financial Planners refer to ….

Here's how his plan now works:

- We've listed his debts from smallest to largest.

- He's focusing on paying off the smallest balance first, while keeping up minimum payments on the rest.

- Once that first debt is gone, the payment amount goes to savings and into his PRSA — turning former debt repayments into future savings.

- Each time a debt disappears, the same process repeats, growing his retirement POT and Sink Funds along the way.

It's a plan that builds discipline automatically. Each milestone frees up more cash flow and strengthens his long-term position.

Looking Ahead

The beauty of this approach is that we can already see his future progress mapped out in Voyant. While no debt has disappeared yet — it's only been a week since our first meeting — he can see the trajectory clearly.

Over the next few months and years, as each debt is cleared, we'll increase his PRSA contributions and continue maximising tax relief. With his level of income, those tax savings will make a significant difference, amplifying every euro redirected from debt to investment.

The Real Choice

As we wrapped up, we talked about the balance everyone faces at some point:

"Do you want to live fully for now, or plan intentionally so you can live comfortably later?"

The truth is, you can do both — it's about being intentional, not restrictive. By taking control of the cash flow and giving every euro a job, he's setting himself up for both freedom and flexibility in the future.

The Takeaway

This case is a great reminder that a high income doesn't automatically lead to wealth — it's structure and direction that make the difference.

By using the debt snowball savings & PRSA planning, and Voyant to visualise the results, we've built a plan that grows stronger over time. It's simple, effective, and most importantly, motivating.

For anyone in Meath (or anywhere in Ireland) who feels like their income isn't going as far as it should, this kind of planning can make a huge difference.

Sometimes, all it takes is seeing your money differently — and a little structure to help it work for you.